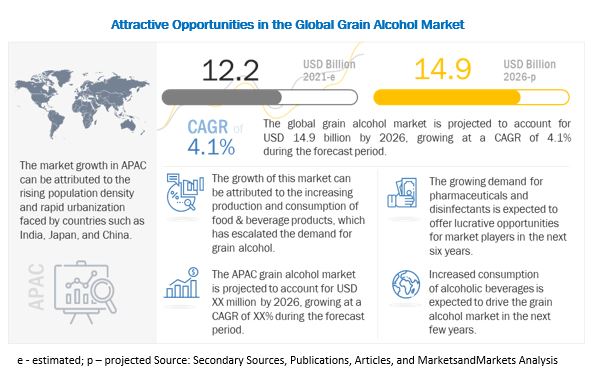

The global grain alcohol market is expected to grow from USD 12.2 billion in 2021 to USD 14.9 billion by 2026, at a compound annual growth rate (CAGR) of 4.1% during the forecast period. Various factors have played a major role in driving the market growth across the globe. The effects of rapid westernization & urbanization have led to the rising demand for grain alcohol in countries other than Europe and the US. A sharp increase in consumer demand for food products containing grain alcohol and rising demand from the food processing industry is also propelling the market. The market for grain alcohol is largely associated with the sale of beverage products. Increasing sales of a variety of beverage and health & personal care products in matured markets of developed economies in the last five years are responsible for the increased growth of the grain alcohol industry.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=8581594

The key players in the industry are adopting growth strategies in emerging countries by enhancing their research capabilities to further develop their product portfolio and strengthen their distribution base. The key players of the grain alcohol industry are focusing on tapping the emerging markets in regions such as Asia Pacific, Latin America, the Middle East, and Africa. Growth in these developing regions over the next few years exhibits promising opportunities for business expansions. Hence, the players in this market can tap new markets to gain profits.

Grain Alcohol Market Drivers: Increasing global beer production and popularity of craft beer

Beer is a widely consumed alcohol beverage, and the production of beer has increased significantly during the last decade. Increasing global demand for beer production is driving the breweries to source grain alcohol from barley. The usage of alcohol manufactured from barely in the beer industry is projected to account for a large share of the market. The growing popularity of craft beer and local beer is likely to further increase the demand for domestic malt over the next five years.

Opportunities: Emerging markets such as Asia Pacific, South America, Middle East and Africa

Due to changing lifestyles, and the rising middle-class population and their disposable incomes, the market for grain alcohol applications have increased substantially in the emerging markets of Asia Pacific, South America, and the Middle East & Africa. These untapped markets have a wide availability of cost-effective labor, advanced technologies, and relatively relaxed regulations on the use of food grade alcohol. Natural sources of grain alcohol such as sugarcane, grains, corn, and other fruits & vegetables are abundantly available in the Asian, African, and Latin American countries. The leading market players have been expanding their facilities in China, India, and Brazil, considering the future potential demand in these markets.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=8581594

North America is estimated to dominate the global grain alcohol market over the forecast period.

The rising consumption of and demand for alcohol has resulted in the use of grain alcohol for beverage applications. In North America, the US is one of the dominant grain alcohol markets. Beer, spirits, and wine are largely consumed alcoholic beverages in this country. The country has no specific law that forbids consumption of alcohol in public but enforces strict laws on age limit for its consumption and purchase. According to the Organisation for Economic Co-operation and Development (OECD), Canada has milder levels of taxation of alcohol at the federal level, but minimum prices and markups are enforced in several provinces, which contribute to raising prices. These trends account for the strong share of the region in global market.

The key players in this market include ADM (US, Cargill (US), Wilmar Group (Singapore), Merck Group (Germany), and Roquette Frères (France). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.