A Concise Prologue to SushiSwap

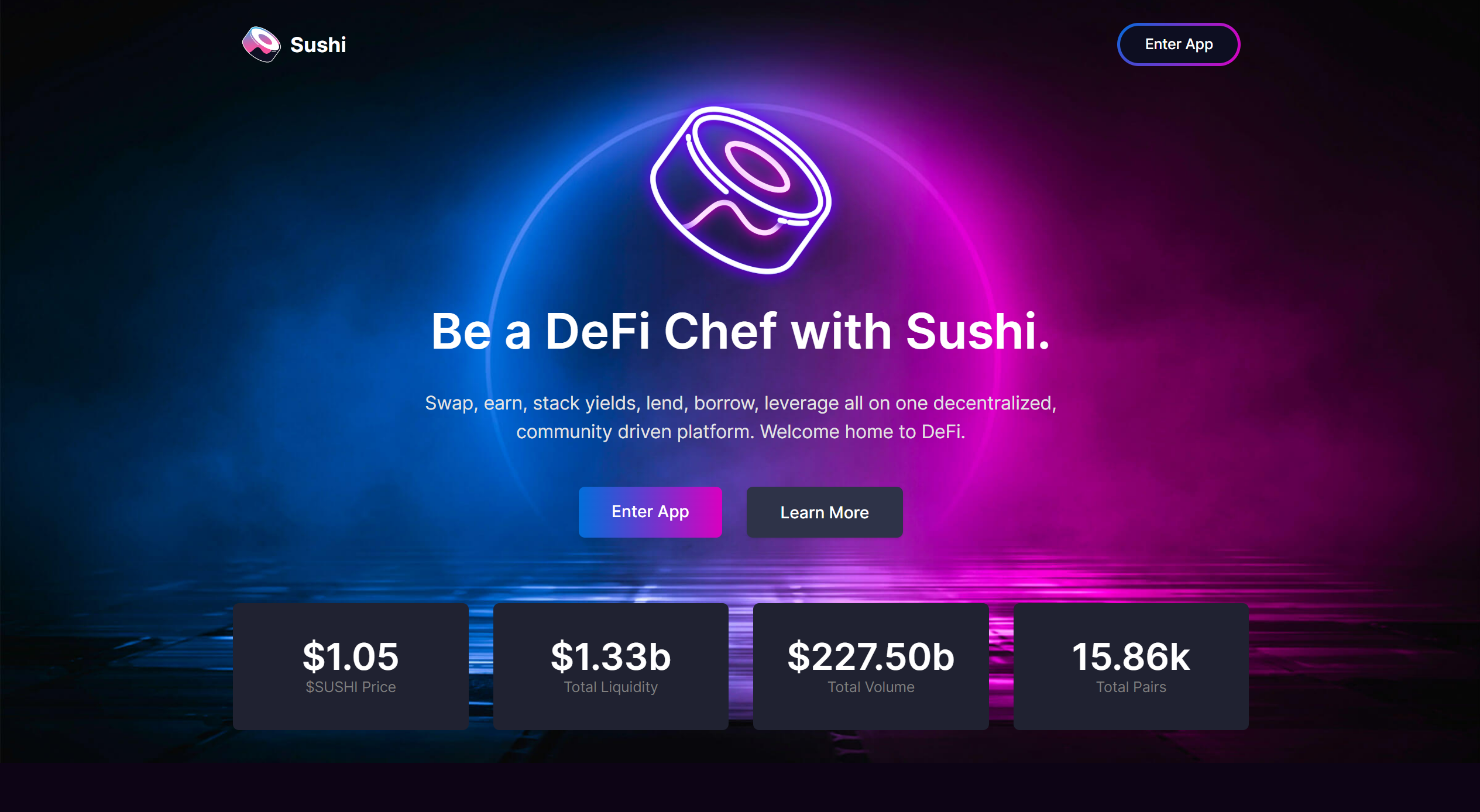

SushiSwap (SUSHI) is a multi-chain decentralized exchange (DEX). The exchange began as a fork of Uniswap that utilizations shrewd agreements to give liquidity pools that permit clients to exchange crypto resources straightforwardly with no delegate.

Clients can likewise become liquidity pool suppliers, providing an equivalent worth sets of two digital currencies in exchange for remunerations at whatever point that pool is utilized.

Sushi is a local area driven association established to address the "liquidity issue" of decentralized exchanges. This issue could be characterized as the failure of different types of liquidity to interface with business sectors in a decentralized way as well as the other way around.

While different arrangements gain steady headway toward tackling the liquidity issue, Sushi's advancement is expected to produce a more extensive scope of organization impacts. Instead of zeroing in on a solitary arrangement, Sushi entwines many decentralized markets and instruments.

Up until this point, the center items are as per the following: a decentralized exchange, a decentralized loaning market, yield instruments, a closeout stage, an AMM system, and marking subordinates.

Sushi's items are planned so the whole stage can keep on advancing on the aggregate establishments while keeping up with the decentralized administration of SUSHI token holders.

While the local area votes on critical underlying changes, our center group at last settles on everyday activities, pool and proportion rebalancing, business system, and in general turn of events.

What Are Liquidity Pools

Liquidity pools are spots where tokens are pooled so clients can utilize them to make SushiSwap exchange a decentralized and permissionless way.

Clients and decentralized applications (dApps) that need to benefit from their utilization make these pools. To pool liquidity, a client's supports should be similarly split between two coins: the essential token (otherwise called the statement token) and the base token (generally ETH or a stablecoin).

SushiSwap's liquidity pools permit anybody to give liquidity to them in exchange for SLP tokens (SushiSwap Liquidity Supplier tokens). A client would get SUSHI-ETH SLP tokens in the event that they saved SUSHI and ETH into a pool.

These tokens address a corresponding portion of the pooled resources, permitting clients to pull out assets whenever. At the point when another client utilizes the pool to exchange among SUSHI and ETH, a 0.3% charge is deducted from the exchange. 0.25% of that exchange is gotten back to the LP pool.

With each exchange, the worth of the SLP tokens, which address the portions of all out liquidity in each pool, is refreshed to add their worth comparative with the tokens used to exchange. Assuming there were already 100 SLP tokens addressing 100 ETH and 100 SUSHI, every token would be worth 1 ETH and 1 SUSHI (In the above model, both ETH and SUSHI have about a similar cost).

Assuming you have perused our Uniswap profound jump article and saw that the two exchanges are particularly indistinguishable: you are on the right track. SushiSwap showed some major signs of life as a fork of Uniswap's V2 code. Nonetheless, these days, Uniswap has continued on toward its third rendition, while SushiSwap extended evenly.

What Are SUSHI, xSUSHI, and SLP Tokens

The SUSHI token is an ERC-20 token. The symbolic serves a few capabilities inside the biological system. SUSHI is a technique for compensating clients with a part of the exchange charges. The token additionally furnishes clients with administration freedoms. You have seriously casting a ballot power on the off chance that you own more SUSHI. Strikingly, SUSHI's symbolic issuance is restricted to 100 tokens for each block.

Notwithstanding, Sushi Swap Liquidity Supplier (SLP) tokens are proof tokens that demonstrate you own a piece of the liquidity pool where your resources are marked. Clients are compensated with SLP tokens when they give liquidity to SushiSwap pools. As a liquidity supplier, you procure exchanging charges, which you can twofold by cultivating your SLP tokens.

At last, xSUSHi is one more stand-out token in the organization. In exchange for marking SUSHI tokens in the Sushibar, you get xSUSHI. To make xSUSHI tokens, you should initially stake SUSHI. xSUSHI tokens are more significant than normal SUSHI.

The xSUSHI token is generally worth in excess of a normal SUSHI token in light of the fact that xSUSHI gathers esteem from stage charges.

By then, Gourmet specialist Nomi chose to return the ETH to the pool. Notwithstanding, the trust had proactively been lost, and responsibility for was moved to Sam Bankman-Broiled. Because of his heavenly history on the lookout, Bankman-Broiled, already the Chief of FTX and Alameda Exploration, helped with reestablishing confidence in the venture.

Why Is SushiSwap Famous: Critical thinking Advantages

SushiSwap's plan, similar to Uniswap's, adds to showcase decentralization. Clients can exchange with liquidity pools and non-custodial wallets straightforwardly.

Accordingly, SushiSwap is more averse to be hacked and offers clients more prominent coin choice adaptability. In correlation with the opposition, SushiSwap gives clients more command over the AMM and its future turns of events.

SushiSwap's Benefits (SUSHI)

SushiSwap takes special care of DeFi clients. Anybody can utilize the stage to trade tokens and add liquidity to pools. SushiSwap offers clients various ways of procuring a recurring, automated revenue with insignificant gamble. SLP tokens can likewise be marked to acquire SUSHI, and SUSHI can be marked to procure xSUSHI and rewards.

Pay From Uninvolved Sources

One of the main benefits of SushiSwap is that most of expenses are discounted to clients. Liquidity suppliers are compensated abundantly for their extra commitments. The SUSHI/ETH pool pays out twofold rewards, which is noteworthy. SushiSwap is the primary AMM to return all benefits to the local area that runs and keeps up with it.

Charges

SushiSwap's charges are lower than those of brought together exchanges like Coinbase. SushiSwap clients pay a 0.3% charge when they join a liquidity pool. A little exchange expense is likewise charged when you endorse the pool of another token.

Administration

SushiSwap's people group administration instrument permits clients to decide on every basic redesign and convention changes. All the more in this way, a piece of all recently given SUSHI is saved for the undertaking's future turn of events. The people group has the potential chance to cast a ballot straightforwardly on which tasks merit this monetary lift.

Support

Since its origin, the crypto market has shown critical help for this venture. Various DeFi stages have given the stage gleaming audits. What's more, days after the venture's public send off, a portion of the world's biggest concentrated exchanges added the stage's symbolic SUSHI. This blend of market and client support helped SushiSwap's quick development.

Cultivating and Marking

SushiSwap gives DeFi clients admittance to well known highlights like marking and cultivating. Numerous new clients favor marking to exchanging on the grounds that it is less tedious and gives more predictable returns.

Many individuals likewise keep thinking about whether cultivating SUSHI on different stages as opposed to marking is a superior choice. One benefit of marking SUSHI over cultivating it is that you can utilize your marked SUSHI on other DeFi conventions.

Utilizing Sushi Swap

There are a few beginning choices while utilizing SushiSwap, yet the most widely recognized is to utilize a fiat entrance. To start, you will require a concentrated exchange that acknowledges government issued money.

Fiat entrances will demand recognizable proof and other data. You can finance your record with government issued money and convert it to ETH or the local coin of the blockchain you need to utilize whenever you've enrolled. You're currently prepared for some SushiSwap.

The initial step when you show up at SushiSwap is to choose a liquidity pool. This step might require some crypto resource research. Recall that AMMs like SushiSwap don't expect ventures to go through a confirmation interaction.

We'll examine how to set up your SushiSwap later in this article above all, how about we perceive how it functions.

SushiSwap (SUSHI): How Can It Work

SushiSwap is a Uniswap hard fork, so it is based on the Ethereum Virtual Machine (EVM) and upholds various blockchains, including:

At the point when clients make exchanges on the SushiSwap exchange, a 0.3% expense is charged. 0.05% of this charge is added to the SushiBar pool as LP tokens. At the point when the prizes contract is called (least one time each day), all the LP tokens are sold for SUSHI (on SushiSwap Exchange).

The recently bought SUSHI is then split relatively between all xSUSHI holders in the pool, meaning their xSUSHI is presently worth more SUSHI. As a result of how the prizes are created, the cost of xSUSHI will increment with the worth of SUSHI, and the worth of one xSUSHI will continuously be more prominent than the worth of one SUSHI.

Sushibar

Another cool element that recognizes SushiSwap is the SushiBar. SushiBar permits you to stake your SUSHI in exchange for xSushi. From that point onward, you can procure more prizes by cultivating in the xSushi pool.

Onsen

Onsen is a liquidity arrangement reward framework for recently gave tokens. In this way, tokens on the Onsen menu are one more likely cause of yield cultivating for clients. To support liquidity arrangement, tokens picked for incorporation on the Onsen "menu" are given a distribution of SUSHI tokens per block.

The upside of being on the Onsen menu is that tasks are not compelled to boost their networks to give liquidity to their tokens since Sushi does it for them. This lightens the weight of brief misfortune and decreases the cost influence/slippage of individual buys, making them more expense proficient.

Onsen additionally helps the Sushi environment by making new tokens more alluring than laid out tokens. Subsequently, the volume is habitually a lot higher than that of different tokens, and each xSUSHI holder gets a level of the complete volume on SushiSwap, which legitimizes boosting liquidity.

Other fascinating highlights like the xSUSHI, SUSHI, and SLP tokens, have been made sense of before in the article.

Instructions to Begin On SushiSwap Dex

Here is an itemized clarification of how to successfully utilize the stage.