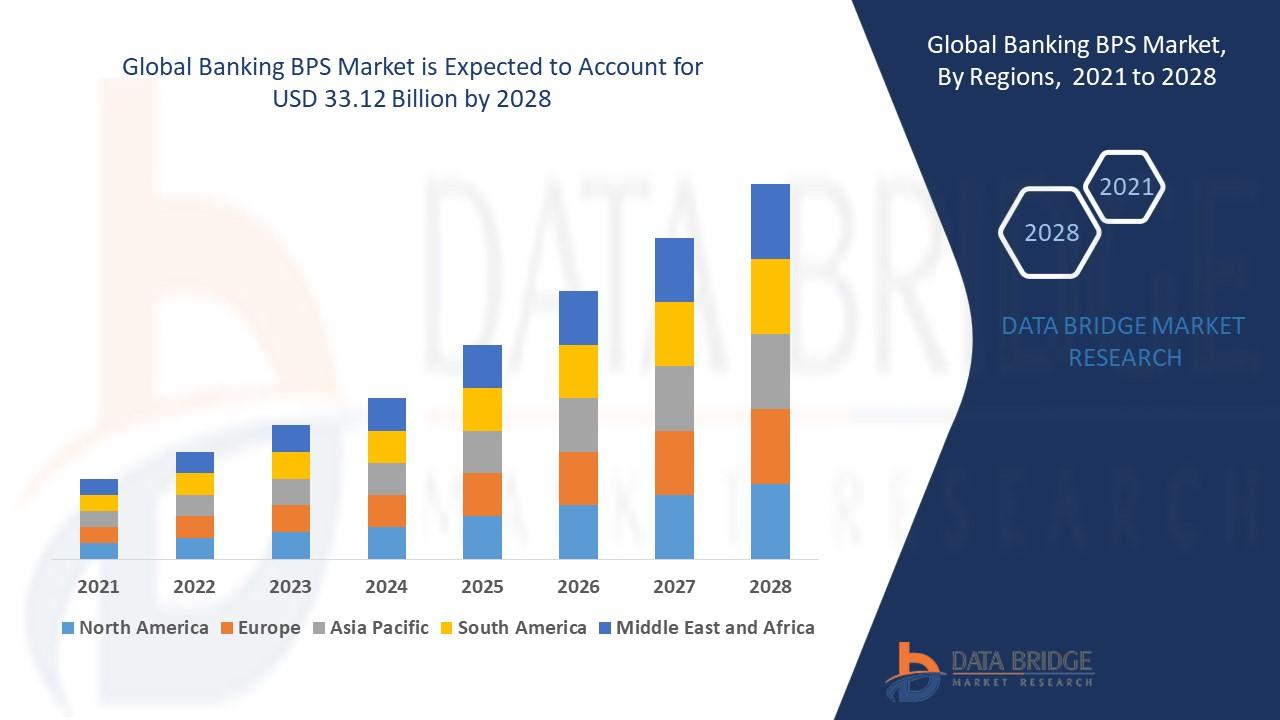

The banking BPS market will reach at an estimated value of USD 33.12 billion by 2028 and grow at a CAGR of 9.57% in the forecast period of 2021 to 2028. Rise in number of public banks acts as an essential factor driving the banking BPS market.

Banking BPS market research report displays an absolute outline of the market that considers various aspects such as product definition, customary vendor landscape, and market segmentation. Currently, businesses are relying on the diverse segments covered in the market research report to a great extent which gives them better insights to drive the business on the right track. The competitive analysis brings to light a clear insight about the market share analysis and actions of key industry players. With this info, businesses can successfully make decisions about business strategies to accomplish maximum return on investment (ROI).

Company snapshot, geographical presence, product portfolio, and recent developments are taken into account for studying the company profiles. Banking BPS market research report has the potential to convince strategic and specific needs of any business in the Banking BPS industry. Furthermore, this Banking BPS market report displays momentous data, current market trends, market environment, technological innovation, upcoming technologies and the technical progress in the related industry. Banking BPS is a professional and a meticulous market report which underlines primary and secondary drivers, market share, leading segments and geographical analysis.

Click Here to Get Latest Sample for Banking BPS Market Report (including COVID19 Impact Analysis) @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-banking-bps-market

Banking BPS Market Scope and Market Size

- On the basis of operation analysis, banking BPS market is segmented into front office, middle office and back office. Front office has been further segmented into customer management services, document management and sales and marketing outsourcing. Middle office has been further segmented into insurance BPS, banking BPS and healthcare providers BPS. Back office has been further segmented into F&A outsourcing and procurement. Mortgage and loan BPS has been further segmented into

- The banking BPS market is also segmented on the basis of service analysis into core banking BPS, mortgage and loan BPS, payment services BPS and securities processing BPS. Mortgage and loan BP has been further segmented into origination services BPS and mortgage and loan administration BPS. Payment services BPS has been further segmented into cheque processing BPS, credit card processing BPS and EFT services BPS. Securities processing BPS has been further segmented into portfolio services BPS and trade services BPS.

Key Players of Global Banking BPS Market

Atos SE, Avaloq, Capgemini, Cognizant, FirstSource, HCL technologies Limited, Hexaware Technologies, Infosys Limited, NIIT Technologies, SLK software services Pvt Ltd, Tata consultancy services Limited (TCS), Wipro Limited, WNS (Holdings) Ltd, Accenture, EXL, Tech Mahindra Business Process Services, DXC Technology Company and Conduent, Inc

MAJOR TOC OF THE REPORT

Part One: Banking BPS Market Overview

Part Two: Manufacturers Profiles

Part Three: Global Banking BPS Market Competition, by Players

Part Four: Global Banking BPS Market Size by Operation Analysis (Front Office, Middle Office, Back Office)

Part Five: Global Banking BPS Market Revenue by Service Analysis (Core Banking BPS, Mortgage and Loan BPS, Payment Services BPS, Securities Processing BPS)

Part Six: Global Banking BPS Market Revenue by Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa)

Get Detail TOC@ https://www.databridgemarketresearch.com/toc/?dbmr=global-banking-bps-market

Key Report Highlights

Comprehensive pricing analysis based on different product types and regional segments

Market size data in terms of revenue and sales volume

Deep insights about regulatory and investment scenarios of the global Banking BPS Market

A roadmap of growth opportunities available in the Global Banking BPS Marketwith the identification of key factors

The exhaustive analysis of various trends of the Global Banking BPS Marketto help identify market developments

Key Questions Answered in Report:

What is the key to the Banking BPS Market?

What will the Banking BPS Market Demand and what will be Growth?

What are the latest opportunities for Banking BPS Market in the future?

What are the strengths of the key players?

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-banking-bps-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

Browse Related Reports@