Brewing Ingredients Market Size, Share, Trends, Key Drivers, Demand and Opportunity Analysis

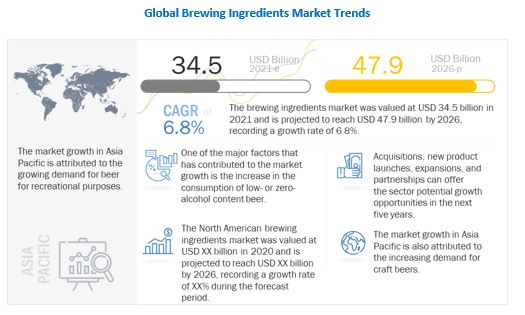

The global brewing ingredients market was valued 34.5 billion in 2021 and is projected to reach USD 47.9 billion by 2026, growing at a CAGR of 6.8% during the study period. The rise in demand for beers from all over the globe, coupled with increasing consumption of craft beers, will drive the market demand and growth of brewing ingredients globally.Various opportunities in near future, such as introduction of new flavors in the beer market and increase in demand for organic beers, will boost the demand of brewing ingredients globally.

According to the Organic Trade Association, US organic beer sales increased more than tenfold since 2003, from USD 9 million to USD 92 million in 2014. Peak Organic Brewing Co. offers organic beers of different types, such as ale and pilsner. Consumer are becoming more aware about their intake, which is resulting in an increase in demand for organic products and clean-label food & beverages with maximum use of natural raw materials and information regarding the traceability of the raw materials used. The concern for traces of pesticides has also resulted in a rise in demand for organic beer, which provide a major opportunity for brewing ingredients manufacturers.

Brewing Ingredients Market Drivers: Increasing demand for low- or zero-alcohol content beer

With changing lifestyles, there is an increase in health awareness. This awareness has created a demand for healthier products in the food & beverage industry. Due to this, the demand for beer with low-alcohol content is increasing. According to the ADM survey, in 2020, a total of 51% of consumers are looking for items that contribute to their metabolic health to promote healthy weight. Low-alcohol products are no longer considered inferior ones. On the other hand, these products are more in demand, as they offer the taste and experience of alcohol - minus the guilt. Consumers are looking for beers with high protein and other nutritious content and reduced carb, sugar, and alcohol content.

The young population, in particular, is more health aware and looking for healthy beverages that won’t sabotage their health goals and commitments. Heineken USA conducted a survey of millennials in 2020, which showed that 52% of respondents had increased the consumption of alcohol-free beer and mocktails. Another major factor for the increase in demand for zero-alcohol content beer is that it allows consumers to drink in moderation and regularly. The survey also shows that 42% of respondents were likely to choose an alcohol-free beer because it allows them to drink regularly.

By brewery size, the craft brewery is estimated to grow at a higher rate in the brewing ingredients market.

According to the Brewers Association, an American craft brewer is a small and independent brewer, where small breweries have an annual production of 6 million barrels of beer or less. The craft brewing industry contributed USD 82.9 billion to the US economy in 2019, with more than 580,000 employees. The average alcohol by volume (ABV) content of a craft beer is 5% to 10%, but some of the most popular craft beers have an ABV of as high as 40%. On the other hand, beer produced in bulk by macro breweries has an ABV of 4% to 6% and as little as 2%. Craft breweries offer different flavors, which allow consumers with different tastes to cater to their preferences. These factors are driving the growth of the craft brewery segment in the global market.

The increasing demand for beers in Asia Pacific countries drives the region's growth rate at a higher pace.

The Asia Pacific region comprises two high-growth economies: India and China. The drinking preferences of the population in this region are gradually shifting toward an alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Hence, beer produced in macrobreweries and craft breweries still has a high-growth rate. Moreover, the increasing spending capacity of consumers has led to a surge in demand for craft beers. There has been an emergence of various craft breweries in countries such as India over the last few years.

Top Companies in the Brewing Ingredients Market

Key players in this market include major players such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK) . These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

- Whats New

- Shopping

- Wellness

- Sports

- Theater

- Religion

- Party

- Networking

- Music

- Literature

- Art

- Health

- Games

- Food

- Drinks

- Fitness

- Gardening

- Dance

- Causes

- Film

- Crafts

- Other/General

- Cricket

- Grooming

- Technology