Battery Market Breakdown: Forecasting Future Trends and Opportunities

Battery Market is segmented by Battery Type (Lead-acid [Flooded, VRLA-Gel, and VRLA-AGM], Lithium-ion, and Nickel-cadmium), Industry Type (Marine, Railway, Defense, Aviation, and Telecom), and Region (North America, Europe, Asia-Pacific, and Rest of the World).

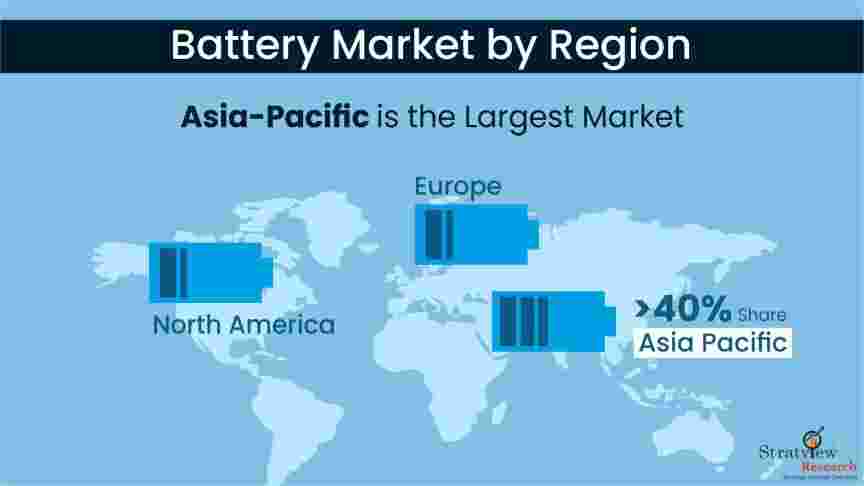

According to Stratview Research, The Battery Market was estimated at US$ 7.4 billion in 2022. With a projected CAGR of 2.7% during 2023-2028, the market is anticipated to reach US$ 8.9 billion by 2028. The Asia-Pacific region is poised to maintain its position as the largest market.

Trends Driving Growth

1. Rise of Electric Vehicles (EVs): The surge in demand for EVs is propelling the battery market forward. Manufacturers are investing in advanced battery technologies to enhance the performance and range of electric vehicles.

2. Renewable Energy Integration: As the world transitions towards renewable energy sources, batteries play a crucial role in storing and distributing clean energy. This trend is driving the adoption of battery storage solutions in residential, commercial, and utility-scale applications.

3. Technological Innovations: Ongoing research and development efforts are leading to breakthroughs in battery technology, such as solid-state batteries and advanced electrolytes. These innovations promise higher energy density, faster charging times, and improved safety features.

Opportunities for Investors

Investors have a plethora of opportunities in the battery market, from investing in established battery manufacturers to backing startups focused on innovative battery technologies. With the market poised for steady growth, strategic investments can yield substantial returns over the long term.

Conclusion

The battery market presents a landscape ripe with potential for growth and innovation. By staying informed about emerging trends and seizing opportunities as they arise, investors can position themselves to thrive in this dynamic and evolving industry.

- Whats New

- Shopping

- Wellness

- Sports

- Theater

- Religion

- Party

- Networking

- Music

- Literature

- Art

- Health

- الألعاب

- Food

- Drinks

- Fitness

- Gardening

- Dance

- Causes

- Film

- Crafts

- Other/General

- Cricket

- Grooming

- Technology