-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Ομάδες

-

Events

-

Blogs

-

Marketplace

-

Forum

-

Παιχνίδια

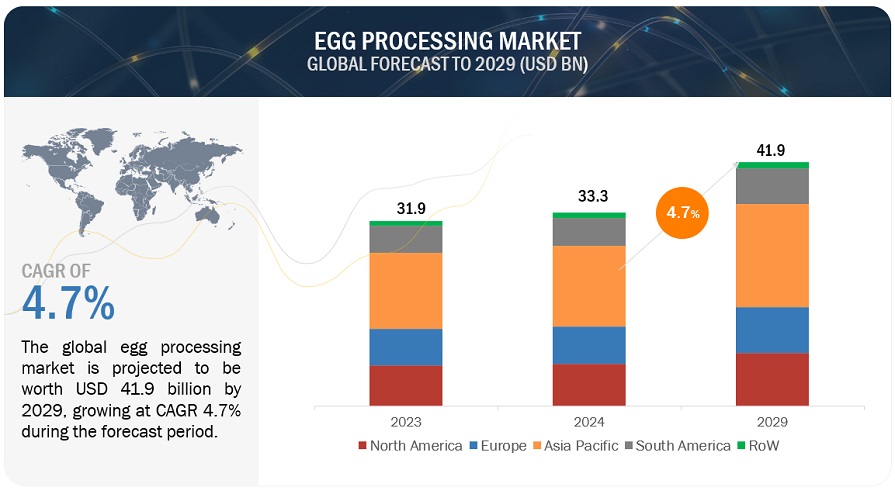

Egg Processing Market Projected to Garner Significant Revenues by 2029

The global egg processing market is expected to reach USD 47.2 billion by 2029, with an estimated value of USD 37.5 billion in 2024, representing a compound annual growth rate (CAGR) of 4.7% from 2024 to 2029. This growth surge is primarily attributed to several key factors, such as consumers are increasing awareness of the nutritional value of eggs, which are rich in protein, vitamins, and essential minerals. This drives the demand for both fresh and processed egg products. The food industry heavily relies on egg products for various applications, such as baking, pasta production, sauces, and dressings. The growth of the food industry, particularly in bakery and confectionery segments, directly translates to increased demand for processed eggs.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=124810046

Opportunities:Cutting-edge technology enhances efficiency and market appeal in egg processing.

The integration of advanced automation technologies in egg production presents a significant opportunity for the industry's growth and efficiency. In Canada, where labor shortages and the transition to cage-free systems are driving forces, investments in automated packing, stacking, and palletization technologies are enhancing operational efficiency and egg quality. For instance, the adoption of automated packing and stacking equipment, such as Damtech's systems, streamlines egg collection and processing, reducing labor-intensive tasks and improving productivity. Additionally, innovations like the Ovoconcept palletizing robot at Rose Valley Colony exemplify how automation can significantly increase efficiency, with the ability to palletize 10,000 eggs in just 30 minutes. These technological advancements not only optimize operations but also improve egg quality and cleanliness, leading to fewer cracked and broken eggs. With potential return on investments as short as four to five years for equipment like the Ovoconcept robot, the adoption of automation offers a promising opportunity for egg processing companies to enhance efficiency, reduce costs, and meet evolving consumer demands.

Dietary Supplements are One of the fastest-growing Food Processing and Manufacturing End-Use Application Segments During the Forecast Period

Processed egg products, such as powders, are increasingly being used in dietary supplements due to their rich nutritional profile and potential health benefits. According to the article provided by EurekAlert in September 2022, Malnutrition affects millions, especially children, in Africa. Egg powder could be a powerful tool to combat malnutrition in children, especially in areas where fresh eggs are scarce. While it lacks some essential fatty acids compared to fresh eggs, it packs a punch of vitamins, amino acids, and trace elements. Plus, it boasts a long shelf life, easy transport, and simple preparation, making it ideal for distribution in deprived areas. A study by the Leibniz Institute for Food Systems Biology confirms its potential, showing that adding egg powder equivalent to one egg daily can significantly reduce underweight and stunting in children. This research highlights the potential of egg powder as a readily available and effective dietary supplement for tackling malnutrition in vulnerable populations.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=124810046

Europe accounts for the second-most dominant position within the egg processing market throughout the forecast period.

According to the European Commission in 2023, the European Union (EU) has over 350 million laying hens, producing nearly 6.7 million tons of eggs annually. France, Germany, Spain, and Italy are the top producers, accounting for more than half the EU's production. Processed egg products are becoming increasingly popular in Europe, driven by growing consumer concerns about animal welfare and environmental impact are pushing egg processors to adopt more sustainable practices, such as sourcing eggs from cage-free hens and using recyclable packaging. However, adapting to evolving consumer preferences and addressing welfare concerns are the major factors contributing to the growth of the market.

- Whats New

- Shopping

- Wellness

- Sports

- Theater

- Religion

- Party

- Networking

- Music

- Literature

- Art

- Health

- Παιχνίδια

- Food

- Drinks

- Fitness

- Gardening

- Dance

- Causes

- Film

- Crafts

- Other/General

- Cricket

- Grooming

- Technology