Commercial Aircraft Propeller Systems Market Emerging Trends, Application, Size, and Demand Analysis by 2030

Commercial Aircraft Propeller Systems Market

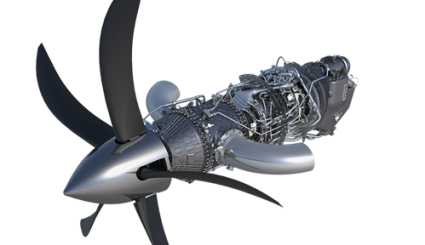

Commercial Aircraft Propeller Systems Market Size Valued at USD 349.15 Million, market Grow at a CAGR Of 4% by 2020 -2030. Commercial aircraft propeller systems find their application in piston-engine and turboprop-powered aircraft. The systems include blades, hubs, and electronic controls. The number of blades in a propeller system ranges from three to six (in a commercial aircraft). The blades are either made of aluminum or composite. The key advantage that composite-based propeller blades offer is reduced weight, which in turn reduces the fuel consumption.

In commercial aviation, turboprop aircraft are primarily used for short-haul regional flights. As of 2015, turboprop accounted for 40% of the total global regional aircraft fleet (including regional jets). The average age of turboprop aircraft fleet is 19 years. North America and Europe have historically been the primary market for turboprops. However, the demand in Commercial Aircraft Propeller Systems Market Report and the Middle East has further helped the market growth.

The market for turboprops had lost momentum with the rapid rise of regional jets since the mid-90s. However, they have started to regain the Commercial Aircraft Propeller Systems market share primarily in the regional transportation segment (aircraft with up to 100 seats).

A turboprop is considered to provide better fuel efficiency as compared to regional jets. Thus, with the rise in global fuel prices, turboprop is bound to become more popular among the regional airlines and low-cost carriers mostly operating in point-to-point short haul routes. Cost pressure plays an important role in airlines' choice for aircraft as it helps determine the operational cost.

OEMs, as well as PMA vendors, are involved in the manufacturing of propeller systems. Thus, the ongoing demand for turboprop aircraft largely supports the market for propeller systems.

Commercial Aircraft Propeller Systems Market – Competitive Analysis:

The commercial aircraft propeller systems market is highly competitive, and vendors compete in terms of cost, component reliability and quality, and market share. To sustain in such an intensely competitive environment, it is crucial for vendors to provide cost-effective and high-quality commercial aircraft propeller systems.

The aerospace industry has witnessed an increased competition and cost pressure. There are also challenges associated with rising fuel costs and increase in price of raw materials. For the aerospace supply chain, it is a threat as well as an opportunity. The vendors with high level of innovation, increased adoption of new technologies, and investment in accordance to the changing market can benefit from the emerging opportunities and thrive in the long run. The vendors should also be capable to easily adjust and adopt according to the shift of market regions, to capture the new market share.

Furthermore, the parts suppliers should coordinate with OEMs to create the products that are fully compliant with all the international aviation, environmental, safety, and quality standards. Cooperation with OEMs is also especially important to increase the reliability and longevity of complex systems.

A trend for consolidation and restructuring in the aerospace industry has become popular worldwide. The aircraft aftermarket parts sector is one of the major sources of income for the majority of the aerospace firms and suppliers. Thus, this trend of consolidation is also felt in the aircraft parts industry including propeller manufacturers. Two major factors are responsible for this change. First, the vendors try to meet customer demands for broader offerings and second, easy capital availability in the market.

The consolidation of aircraft part manufacturers and suppliers, both in OEM and aftermarket segment, has always been strong. Now with the motive for providing broader offerings, it is obvious that bigger and more diversified companies can provide more comprehensive services to customers. Along with the growth in scale and market presence of the company, one can offer more services across the globe. Thus, the parts market consolidation is likely to increase. For example, UTC Aerospace Systems was formed as a result of a merger between Hamilton Sundstrand and Goodrich. It manufactures propellers for many turboprop aircraft including ATR family of aircraft.

Industry/ Innovation/ Related News:

December, 2017: - Dowty Propellers signed a contract with AVIC Aircraft Co. Ltd. for the design, development, production, and in-service support for the propeller system on the MA700, a twin-engine airliner.

June, 2014 - Dowty Propellers signed a contract with India's SpiceJet airline company, to provide a complete support package for the propeller systems equipped on the airline's 15 Bombardier Q400 regional aircraft.

Commercial Aircraft Propeller Systems Market – Segments:

For the convenience of the report and enhanced understanding; the commercial aircraft propeller systems market is segmented in to two key dynamics:

Segmentation by Solution: Blades, Hub Systems, and Digital Electronic Controls.

Segmentation by Regions: Comprises Geographical regions –Americas, Europe, APAC and Middle East and Africa.

Commercial Aircraft Propeller Systems Market – Regional Analysis:

APAC region has emerged as one of the potential markets for turboprop sales. As a result, manufacturers are focusing their new product launch targeting this region. For example, ATR, one of the leaders in turboprop sales in the Commercial Aircraft Propeller Systems market has launched two new versions of its ATR 72-600 in the region. The launch customers for both the versions are from APAC region, namely Cebu Pacific from Philippines and Air Niugini from Papua New Guinea.

ATR 72-600 consists of 568F-bladed propellers from Hamilton Sundstrand (merged with Goodrich in 2012 to form UTC Aerospace Systems). The company provides complete propeller system solutions including blades, hubs, and digital electronic controls that incorporate aerodynamics as well as control dynamics.

China, India, and the Philippines are some of the emerging aviation and aircraft propeller systems market in the Commercial Aircraft Propeller Systems market region, and their growth rates are expected to surpass other regions (EMEA and Americas) over the period 2016-2021. The aircraft propeller systems market is expected to grow in the future because of increased aircraft demand, aviation MRO activities, and aircraft parts production capability.

Few of the countries in Commercial Aircraft Propeller Systems Market Trends are aggressively pushing for policies and reforms to attract the US and European aircraft and parts manufacturers to establish local operations in their respective countries. Since 2010, Malaysia has been offering corporate tax exemptions and other investment schemes to companies that invest in the local aviation industries. Many of the commercial aircraft suppliers are now concentrated in Southeast Asian countries like Singapore, Malaysia, Vietnam, Indonesia, Australia, and Thailand and are continually adding a wide range of parts manufacturing capacity to their portfolio.

Thus, the commercial aircraft and aircraft parts manufacturing market has largely developed in Commercial Aircraft Propeller Systems market in recent years. Major regional commercial aircraft programs are undergoing in this region. For example, China's Xian Modern Ark 700 (MA700) is one such twin-engine turboprop aircraft being developed by Aviation Industry Corporation of China (AVIC). It is a 70-seat aircraft powered by PW150C engines from Pratt & Whitney, planned for its first flight in 2016.

The strengthening of regional aircraft manufacturers along with the growing demand for aircraft from Airbus and Boeing is further expected to create an inflow of many other parts manufacturers and suppliers into the Commercial Aircraft Propeller Systems market.

Commercial Aircraft Propeller Systems Market: Information by Component (Blade, Hub, Spinner, and Others), by Propeller Type (Fixed Pitch and Varying Pitch), by End Use (OEM and Aftermarket), and by Region (North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America)—Forecast till 2030

Related Links:

· Drone Logistics and Transportation Market Research Report: Information by Solution (Shipping, Warehousing, Infrastructure and Software), Drone (Freight Drones, Passenger Drones and Ambulance Drones), Application (Commercial and Military) and Region (North America, Europe, Asia-Pacific, Middle East & Africa and Latin America) - Forecast till 2030

· Explosive Trace Detection Market Research Report: Information by Technology (Chemiluminescence (CL),Ion Mobility Spectrometry (IMS), Mass Spectrometry (MS), Thermo-Redox, Surface Acoustic Wave (SAW), Chemical Reagents, and Ultraviolet Fluorescence), System Type(Portable, Semi-Portable, and Fixed Site), Application (Commercial [Airports, Railways, Retail Markets, Ports, Cargo & Vehicles, Banking, Financial Services, & Insurance (BFSI),and Others]and Military & Defense [Law Enforcement, Homeland Security, and Others]) and Region - - Forecast till 2030

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact:

Market Research Future®

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Phone:

+1 628 258 0071(US)

+44 2035 002 764(UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com

- Whats New

- Shopping

- Wellness

- Sports

- Theater

- Religion

- Party

- Networking

- Music

- Literature

- Art

- Health

- Games

- Food

- Drinks

- Fitness

- Gardening

- Dance

- Causes

- Film

- Crafts

- Other/General

- Cricket

- Grooming

- Technology